Why Elon Musk Wanted to Buy Twitter, and Then Changed His Mind, and Then Got Sued

- Cup O Content

- Jul 20, 2022

- 4 min read

Updated: Apr 8, 2024

Some people want it all. But in America, our billionaires take “wanting it all” to a whole new level. Maybe that’s why a man with over 100 million Twitter followers (as of July 14, 2022), who already owned 9 percent of Twitter, felt he needed to protect free speech by, um, buying all of Twitter.

"Free speech is the bedrock of a functioning democracy, and Twitter is the digital town square where matters vital to the future of humanity are debated," said Mr. Musk in a press release that also noted he was paying $44 million for the platform.

Of course, Musk also had other plans.

"I also want to make Twitter better than ever by enhancing the product with new features,” the press release continued, “making the algorithms open source to increase trust, defeat spam bots, and authenticate all humans.” So far, so good.

After all, Twitter does have a well-documented history of bot issues, and if Elon had a plan to fix that, so much the better. And while “authenticating humans” sounds futuristic, it’s really just a cool way to say he wants to confirm that audiences and users are real people, which in turn increases advertiser confidence, which then boosts ad spending, which increases revenue, and so on.

The Deal Goes Sour

Although there was a lot of excitement around that April announcement, behind closed doors, things were not going to plan. In July 2022, Musk announced he was terminating the deal because he did not have enough information to determine if Twitter was accurately reporting the level of fake accounts. Musk claimed Twitter was refusing to share the requested information.

Within a few days of that announcement, Twitter announced it was suing Musk in an attempt to force him to close the deal. In Twitter’s complaint, they noted that "having mounted a public spectacle to put Twitter in play, and having proposed and then signed a seller-friendly merger agreement, Musk apparently believes that he—unlike every other party subject to Delaware contract law—is free to change his mind, trash the company, disrupt its operations, destroy stockholder value, and walk away."

Who’s right? Who’s wrong? This blog isn’t interested. But we ARE interested in examining why Musk may have wanted to buy Twitter, what he had to gain financially, and what happens to that value if Twitter is misrepresenting the percentage of fake accounts.

Was Twitter a Bargain?

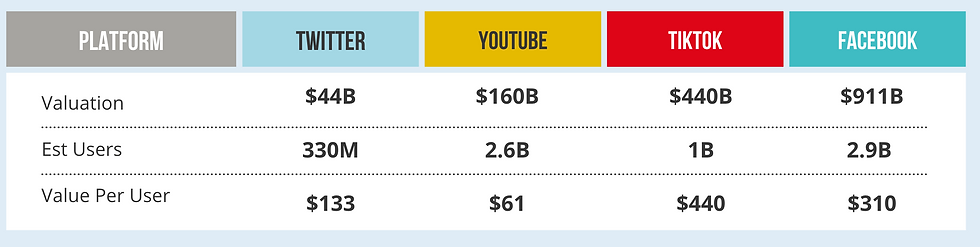

While $44 billion may sound like a lot, if you’re a billionaire looking to buy an established social media platform, Twitter may be the digital equivalent of a bargain. According to some published estimates, YouTube is valued at $160 billion, TikTok is valued at $440 billion, and Facebook is currently valued at $911 billion.

But of course, bargains in the digital world are based on the value of users (real live users, not bots) and the ability to advertise to those users. If Twitter has 330 million active users (as some sources report), then the cost per user would be $133. (See chart below.)

Using various sources, we figured out the approximate cost per user (based on the above evaluations and published guestimates of users at the time of this writing) for Facebook, YouTube, and TikTok. These calculations are interesting because they show how cost per user currently influences an evaluation.

Elon Musk has a team that has determined that each Twitter user is worth $133 based on potential ad revenue. (Is that valuation correct? Who knows?) But look at what happens to the value of the company when the number of real users declines.

While Twitter's quarterly reports say that fewer than 5 percent of its users are fake accounts, some experts guess that fake accounts are 10 percent, 25 percent, or even 50 percent of the platform’s population. If any of those guesses were correct, Musk would be overpaying by billions. And even billionaires don’t like to overpay by those margins.

Of course, these percentages are hypotheses and are not based on any published facts or known reporting. But Musk seems to have heard the whispers and has his doubts.

What Does This Mean to Advertisers?

Cup O Content manages Twitter ads for many of our clients. However, we do not use them as the foundation of any efforts. Like many other advertisers, we have encountered issues with bots and fake accounts. Twitter’s ad performance is somewhat unreliable and has been for years. But that doesn’t mean it’s not a good choice for some types of campaigns.

Like most advertisers, Cup O Content’s clients see that Twitter ads produce very high numbers of clicks at a low cost per click. However, advertisers should assume that about 25 to 50 percent of those clicks are from questionable sources.

That means that advertisers need Twitter to outperform other platforms by about 2:1 to stay in the mix. And it often does this, especially for accounts that are promoting articles, news, and information.

Musk’s allegations may force Twitter to reveal its evaluation formats in court.

Twitter may have to submit to unprecedented third-party audits.

Musk may need to produce evidence for reasonable doubt to counter Twitter’s claims.

A lawsuit over the number of fake accounts might open the door to a long line of new and exciting developments in credibility, reporting, and even the elimination of many fake accounts.

How will this lawsuit affect Twitter’s advertisers?

If ANY of this happens, it will provide advertisers with a much deeper insight into the effectiveness or waste of Twitter ad dollars. But that’s unlikely. The more probable scenario is that Musk will demand open records, Twitter will refuse, and Twitter drop the lawsuit to protect the integrity (or lack of integrity) of its algorithms.

We can’t wait to see how it all plays out.

Want to read more articles like this? Check these out.

Comments